Pension Awareness Week 2025

The world of pensions can look complicated from the outside, and there are plenty of questions people want to ask but never do. Outlined below are some of the questions people want to ask but for whatever reason, may not.

When should I start saving for retirement?

The simple answer is as soon as you can.

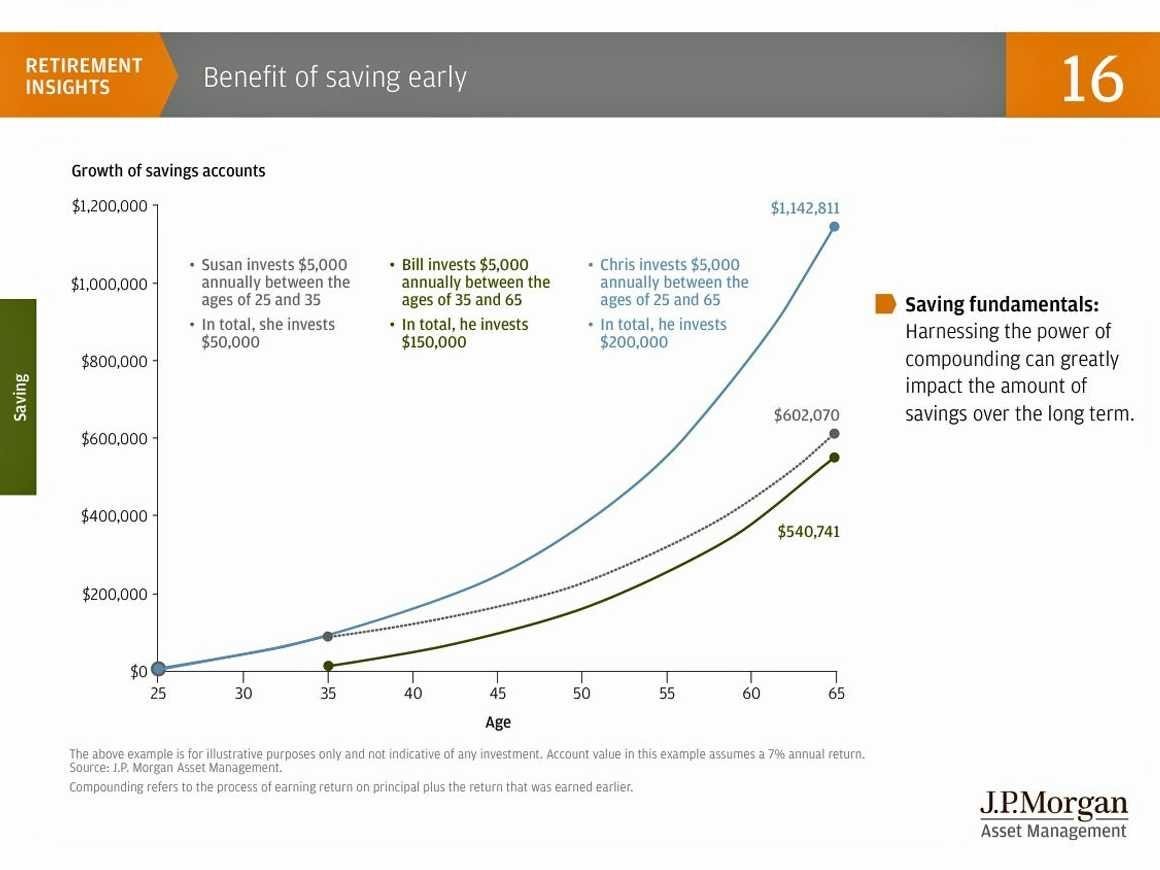

According to the Money & Pensions Service survey of people aged 18-25, 54% are not currently contributing to a pension and 29% of people of that age bracket have never contributed to any pension. The below graph from JP Morgan outlines the importance of starting as early as you are able and the advantage that can be gained from long term compounding.

Simply starting 10 years prior, at 25 rather than waiting until you’re 35 can nearly double your amount at a retirement age of 65.

You can also contribute lump sums to your pension should you receive a bonus or gift from a relative.

The Power of Compounding, Student Loan Debt, Communism, and Stealth Wealth

How much should I save?

Budgeting is a key tool in financial planning and retirement planning. You should save as much as you are comfortable doing so as once your pension is up and running, you may not access it until you turn 55 under current legislation. It is important to know your incomings and outgoings to know how much spare income you have to set aside for your retirement.

It is also important to look ahead, what kind of life do you want to live in retirement? For many people it is a time to spend time with family, travel and slow down a little more and at the beginning, this can be costly, although this tends to diminish as we move further into retirement.

What investment options should I pick?

Investments is not a ‘one size fits all’ discussion and the answer to the above is highly reliant on your age, views on risk, capacity for loss and many other factors. So while we cannot provide a simple answer to the above question, we can showcase the importance of taking action and reviewing these, and not relying on the ‘standard’ investments you may buy into as part of a workplace pension.

By way of example, a 30-year-old opens a pension with a view to retiring at age 65. By contributing £200 per month, and with the employer matching this we see vastly different amounts, from different investment returns.

A 2% annual investment return would result in a value of £116,000 at age 65, while a 5% annual investment return would result a value of £207,000, nearly double.

An inflation rate of 2% has been applied to the above returns. While these returns are not guaranteed, it shows the necessity and benefit of keeping an eye on your investments and not opting for the ‘standard’ option, as it may not be the right option for you.

Source: Nucleus Financial Services illustration tool.

What is salary sacrifice? And should I use it?

You may already be familiar with the government backed cycle to work scheme. This allows your employer to sacrifice a small portion of your pre-tax salary in exchange for the payments towards a bike, which can then be made before tax and national insurance deductions.

Salary sacrifice in pensions works much the same way, allowing you to contribute to your pension at much higher rates due to the lack of deductions. This can be incredibly beneficial over the long term as it doesn’t change your take home amount, but will increase contributions.

What’s the difference between a pension and an annuity?

At its simplest form, an annuity is a guaranteed income in exchange for a lump sum of money from your pension. In more detail, plenty of add ons and terms can be added so that an annuity can continue paying after you pass away, offer a lump sum on death and many more bells and whistles. The key theme however, is a guarantee.

The main difference between pensions and annuities is the flexibility vs guarantee. Especially modern SIPPs, can be accessed at will and be taken annually, quarterly, and in whatever amount you desire. Once purchased, an annuity amount is set.

A hybrid approach may also be an option to consider, to provide an income for your base expenses while your pension remains open, invested and can be accessed at will for larger ad hoc expenses, like a wedding or home improvement.

What’s Changing about pensions?

As I said earlier, pensions and retirement legislation is a constantly evolving landscape, and there are several changes currently underway regarding this.

A widely discussed and debated change, is the inclusion of pensions to estates for inheritance tax purposes from April 2027, prior to this date, pensions will be able to be passed down to beneficiaries without being included under the inheritance tax umbrella (and free of tax should the donor pass away before 75).

Currently, your pension savings are also locked in until you reach age 55. This will increase to age 57 in 2028. It may be possible for you to start taking your pension savings before age 55 if your health means you can no longer carry on working.

Conclusion

Pensions and retirement is an incredibly broad topic and consistently changing. With this in mind, there really are no ‘silly questions’ and myself and the staff at Thorntons Wealth are always happy to help.

This information has been prepared using all reasonable care. It is not guaranteed as to its accuracy, and it is published solely for information purposes. Our opinions are subject to change without notice, and we are not under any obligation to update or keep this information current. It is not to be construed as a solicitation and does not in any way constitute advice. Past performance is not a reliable indicator of future performance. The value of investments can fall as well as rise and clients may not get back the amount originally invested.

This article does not in any way constitute investment or tax advice. Any information concerning the tax treatment of an investment is based on our understanding of current HMRC rules which may be subject to future change. Tax advice is not regulated by the Financial Conduct Authority.